Discover the secrets behind Danaher’s huge success story

DANAHER FAST FACTS

Ticker: DHR:NYSE

Share price: $253

Market cap: £141.5 billion

US biotechnology, life sciences and diagnostics company Danaher (DHR:NYSE) is one of the most successful companies to list on the New York Stock Exchange that few people outside the US have heard of.

This feature peeks under the bonnet to see how the company has achieved its success and explores its prospects.

Steven and Mitchell Rales and a group of investors acquired a struggling conglomerate in the 1980s and renamed it Danaher Corp. A $1,000 investment in Danaher in 1984 would today be worth around $1.8 million excluding reinvested dividends.

That is equivalent to a CAGR (compound annual growth rate) of 21% a year. To put that into context Warren Buffett’s Berkshire Hathaway (BRK-B:NYSE) has delivered a CAGR of 17% a year over the same period.

A lot can change over 40 years, yet interestingly one aspect of Danaher has not changed in that time. The brothers originally envisioned building a company with a focus on continuous improvement and customer satisfaction.

The idea was inspired by the Japanese business philosophy of Kaizen which means change for the better.

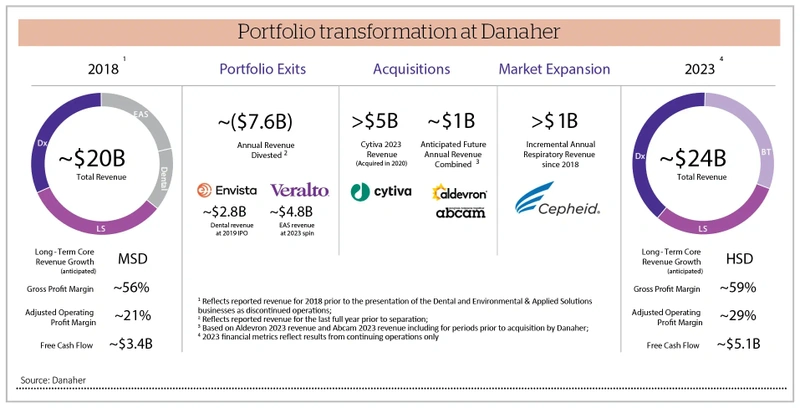

HOW HAS THE BUSINESS EVOLVED?

Today the DBS (Danaher Business System) sits at the core of the company’s operations and strategic focus. Before describing the business in more detail, it is worth looking back to see how it evolved.

The Rales brothers originally established a group of manufacturing businesses with a view to improving them and extracting value. From the early 1990s the company started to organise around strategic platforms with sustainable competitive advantages and structural growth drivers.

Over the next few decades Danaher built leadership positions in the science and technology sectors which define the company today. Strategic acquisitions have played a key role in expanding and broadening Danaher’s reach and capabilities.

For example, in 2012 Danaher purchased Kiva Systems, a robotics company which has helped drive efficiency and productivity at Amazon’s (AMZN:NASDAQ) fulfilment centres worldwide.

Management believes DBS is at the heart of the company’s success. It nurtures innovation, reduces time to market and delivers ground-breaking products and solutions.

WHAT IS THE SHAPE OF THE OVERALL BUSINESS TODAY?

The company is organised under three platforms or divisions which house companies operating in their own niche. The largest is diagnostics which contributed 44% of revenue and 64% of group operating profit respectively in the first quarter of 2024.

The diagnostics platform is comprised of cancer diagnostics company Leica Biosystems, blood sample testing firm Radiometer, and complex biomedical diagnostics specialist Beckman Coulter. First-quarter diagnostics revenue grew 7.5% to $2.5 billion.

The life sciences platform generates 30% of group revenue and 18% of operating profit. First-quarter revenue grew 2% to $1.75 billion.

Companies on the platform include the recently acquired Abcam which some readers may recall was one of the most successful AIM stocks before it moved its main listing to Nasdaq. Abcam is a producer, distributor, and seller of protein research tools.

Other life sciences businesses include Sciex, a leader in mass spectrometry, Molecular Devices which provides instruments and services for clinical and pre-clinical bioanalysis, and Aldervron which notably provided the technology which supported the DNA template for Moderna’s (MRNA:NASDAQ) Covid-19 vaccine.

Cytiva is Danaher’s biotechnology arm and provides deep expertise, technology and services to accelerate the commercialisation of life changing therapies. It generated 26% of group revenue and 25% of group operating profit in the first quarter as revenue fell 18% to $1.5 billion.

The business was purchased from General Electric (GE:NYSE) in 2020 for $21.4 billion.

!function(){"use strict";window.addEventListener("message",(function(a){if(void 0!==a.data["datawrapper-height"]){var e=document.querySelectorAll("iframe");for(var t in a.data["datawrapper-height"])for(var r=0;r < e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

HOW DO THE FINANCIALS STACK-UP?

The franchises operating under the Danaher umbrella have established leading market positions in attractive, fast growing end markets with secular growth drivers. A focus on high value, mission critical applications helps to generate steady recuring revenues and high margins.

It is therefore perhaps not surprising to see high quality financial metrics at the group level. Danaher generates healthy gross and operating margins of 60% and 30% respectively.

The company generated $1.4 billion of free cash flow in the first quarter of 2024 which represents a conversion ratio to net income of 130%.

In the 2023 financial year, the company converted more than 100% of net profit into free cash flow for the 32nd consecutive year.

Turning to the balance sheet and financial strength, net debt to equity, a measure of financial leverage is a modest at 23% and net debt to total assets is 15%.

Stripping out goodwill and net intangible assets to arrive at the amount of tangible operating capital deployed, the business generates a very respectable return on capital of around 35%.

Looking at consensus earnings estimates the market is forecasting 30% growth in 2024 and 14% in 2025. At the current share price that translates into a forward PE (price to earnings) multiple of 33 times and 29 times, respectively.

Over the last year earnings forecasts for 2024 and 2025 have been revised down by around 25% according to Refinitiv data.

!function(){"use strict";window.addEventListener("message",(function(a){if(void 0!==a.data["datawrapper-height"]){var e=document.querySelectorAll("iframe");for(var t in a.data["datawrapper-height"])for(var r=0;r < e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

CURRENT TRADING

The company delivered better than expected first quarter earnings (23 April) with adjusted EPS (earnings per share) coming in at $1.92 compared with Wall Street estimates of $1.71.

Revenue dropped 2.5% year on year to $5.8 billion but this was ahead of consensus estimates calling for $5.6 billion. Broad-based strength in diagnostics was offset by declines in biotechnology and weakness in China where the economic landscape remains challenging, according to the company.

CEO Rainer Blair said: ‘We were especially pleased to see improving order trends in our bioprocessing business and believe we continued to gain market share in our molecular diagnostics business.

‘Looking ahead, the powerful combination of our leading portfolio and our team’s commitment to executing with the Danaher Business System provides a strong foundation for differentiated long-term performance while helping to meaningfully improve human health.’

For the full year management expect a gradual improvement to a core revenue growth rate of high-single digits or better as the business exits 2024.

DANAHER SWOT ANALYSIS

Strengths

- A globally diversified portfolio of businesses mitigates macro risks

- High margin, high growth businesses are resilient

- Focus on consumables increases revenue visibility

Weaknesses

- Acquisitions can be challenging to integrate successfully

- Increased debts can restrict operational flexibility

Opportunities

- Global footprint presents more opportunities

- Capitalise on technological leadership to leverage new growth markets

Threats

- Company must continually innovate to stay ahead

- Rapid technological advancements can erode market share and margins

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Barclays breaks to 52-week high despite lower earnings

- Shoe Zone shares slump on fears over trading and higher costs

- Stagflation fears rise on resilient US economy and sticky core inflation

- Alphabet joins Meta in shareholder dividend commitment

- What is happening at Smithson after continuation vote dissent?

magazine

magazine